Unlock the secrets behind the surge in FDI in India for 2024! Explore attractive PLI schemes and macroeconomic factors driving foreign investments. Dive into the financial future now!Table of Contents

Foreign Direct Investments (FDI) into India are gearing up for a grand performance in 2024, ready to take center stage in the global investment arena. Despite the tumultuous waves of geopolitical uncertainties and a globally tighter interest rate regime, the subcontinent stands resilient and robust, beckoning foreign players with its charm.

PLI Schemes and the rise of fdi in india

The star of this economic extravaganza? The Production Linked Incentive (PLI) schemes, stealing the spotlight in sectors like pharma, food processing, and medical appliances. Rajesh Kumar Singh, the maestro behind the scenes at the Department for Promotion of Industry and Internal Trade (DPIIT), assures us that these schemes are more than just choreography—they’re yielding tangible fruits and drawing in foreign investors.

In the opening act of 2023, FDI faced a 22% decline, prompting worried whispers. But fear not, as Singh reassures us that this is just a plot twist in the larger narrative of FDI growth. From 2014 to 2023, FDI inflows have doubled, reaching an impressive USD 596 billion. Talk about a plot twist!

The Global Stage and India’s Starring Role

On the global stage, experts give a standing ovation to India’s enduring charm as the preferred investment destination. The country’s commitment to ease of doing business, a skilled workforce, natural resources, liberal FDI policies, and a colossal domestic market continues to capture the attention of investors worldwide.

Rumki Majumdar, an economist at Deloitte India, predicts a plot twist in the form of rising capital flows. She attributes the recent slowdown to global liquidity tightening and geopolitical uncertainties but believes the world will soon recognize India’s economic strength.

UNCTAD’s World Investment Report 2023—A Positive Twist

A cameo appearance by the UNCTAD’s World Investment Report 2023 adds a positive twist to the story. Greenfield investment projects in developing countries rose by 37%, signaling a positive outlook for industry and infrastructure investments. The plot thickens!

Curtain Call—India’s Economic Encore in 2024

As the curtain falls on 2023, India takes a bow with impressive economic statistics. A 7.7% growth in the first half of 2023-24, foreign exchange reserves soaring above USD 600 billion, and industrial production hitting a 16-month high of 11.7% in October. Bravo!

The Supporting Cast of FPIs in the Indian Equity Market

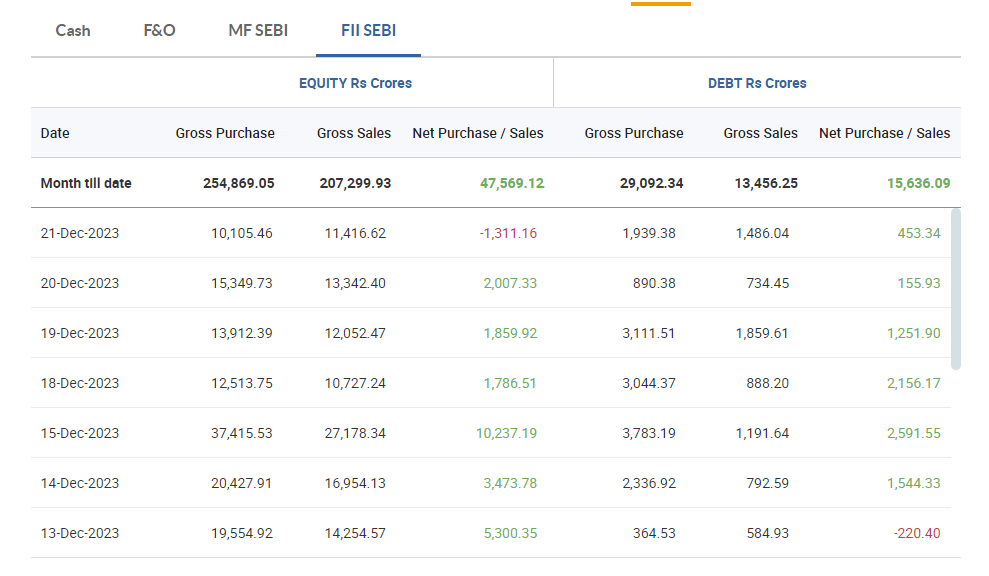

But wait, there’s an exciting subplot! Foreign Portfolio Investors (FPIs) are stealing the limelight in the Indian equities market. With over Rs 57,300 crore poured in this month alone, FPIs are reveling in the stability of Indian politics, robust economic growth, and the gradual decline in US bond yields.

V K Vijayakumar, the Chief Investment Strategist at Geojit Financial Services, predicts a thrilling climax in 2024. As U.S. interest rates decline, FPIs are gearing up for an encore performance, increasing their purchases and adding to the financial drama.

Also Read | Will the new COVID variant (JN.1) impact the Indian stock market?The Finale—India’s Economic Symphony Continues

As the final act approaches, the stage is set for India’s economic symphony to continue into 2024. The key players, FDI and FPIs, are ready for an encore, driven by India’s enticing economic factors and global economic cues. So, fasten your seatbelts and get ready for the financial rollercoaster that is sure to make headlines in the coming year!

1 thought on “FDI in India is set to surge in 2024, commencing with a robust investment of Rs 57,300 crore in equity during December”